fixnova.site

Gainers & Losers

What Qualifies A House For Fha Loan

You need to look for homes that are in Fair condition or better. They need to have functioning appliances, no mold or water issues, no obvious. FHA Loan Requirements and Guidelines · Minimum Credit Score: · Down Payment: % if your credit score is + and 10% if your credit score is between Most homes are eligible for FHA loan financing, as long as they meet the FHA's property standards. An FHA appraiser will assess the home and surrounding. WHAT ARE THE REQUIREMENTS FOR AN FHA LOAN? · A minimum down payment of % · Steady income and employment · A debt-to-income ratio should not exceed 43% · The home. Because FHA loans are intended to offer additional options for potential homebuyers with moderate or lower incomes, they come with some perks, typically. The. To qualify for an FHA loan, you need a minimum credit score of , which is much lower than for conventional home loans, but it comes with a higher down. Important FHA Guidelines for Borrowers · FICO® score at least = % down payment. · FICO® score between and = 10% down payment. · MIP (Mortgage. They provide general guidance for determining the property's eligibility for FHA mortgage insurance. For instructions on filling out the VC form, see the. It would need to be within the FHA county loan limits which vary nationwide but hover right around $k in most areas and there needs to be no. You need to look for homes that are in Fair condition or better. They need to have functioning appliances, no mold or water issues, no obvious. FHA Loan Requirements and Guidelines · Minimum Credit Score: · Down Payment: % if your credit score is + and 10% if your credit score is between Most homes are eligible for FHA loan financing, as long as they meet the FHA's property standards. An FHA appraiser will assess the home and surrounding. WHAT ARE THE REQUIREMENTS FOR AN FHA LOAN? · A minimum down payment of % · Steady income and employment · A debt-to-income ratio should not exceed 43% · The home. Because FHA loans are intended to offer additional options for potential homebuyers with moderate or lower incomes, they come with some perks, typically. The. To qualify for an FHA loan, you need a minimum credit score of , which is much lower than for conventional home loans, but it comes with a higher down. Important FHA Guidelines for Borrowers · FICO® score at least = % down payment. · FICO® score between and = 10% down payment. · MIP (Mortgage. They provide general guidance for determining the property's eligibility for FHA mortgage insurance. For instructions on filling out the VC form, see the. It would need to be within the FHA county loan limits which vary nationwide but hover right around $k in most areas and there needs to be no.

What Are FHA Loan Requirements? · Credit Scores and Down Payments · History of Honoring Debts · Proof of Steady Employment · Sufficient Income · FHA Mortgage. Do FHA loans require an appraisal? You have to get an FHA home appraisal if you're planning to refinance or use an FHA loan to buy a house. In most cases. Single family homes, town homes and FHA approved condos · Generous loan amount limits – $, in most counties. · Only % down payment – max % financing. An FHA home loan is a mortgage option that's backed by the Federal Housing Administration (FHA). Designed for low- to moderate-income borrowers, FHA home loans. Types of Homes that Qualify for FHA Loans · Manufactured Homes · Fixer-Uppers · Mixed-Use Properties · Multifamily Housing · A Second Home. Homes that qualify for FHA loans must meet HUD home building guidelines. Additionally, the home value must be above the floor and under the ceiling loan amounts. Credit score of at least While conventional loans tend to require a minimum credit score of , you may be able to qualify for an FHA loan with a credit. How do you qualify for an FHA loan? · A credit score of or higher (less than , but no less than would require at least a 10% down payment) · No history. The answer to this question is "no." There are no minimum income requirements for FHA loans. However there is often a maximum debt-to-income ratio (DTI). To pre-qualify for an FHA loan, you'll need: 1. Verifiable income. 2. Ability to afford the housing payment and any existing debt. 3. Have at least % for a. They provide general guidance for determining the property's eligibility for FHA mortgage insurance. For instructions on filling out the VC form, see the. In other words, your gross monthly income multiplied by equals the monthly mortgage payment you can afford, according to FHA guidelines. If your ratio is. FHA Loan Requirements · Credit Score. FHA loans require a minimum credit score of , though most lenders require at least and minimum requirements can vary. Eligibility for an FHA (k) loan requires the property to meet certain standards, and the loan can cover a variety of repairs, from structural alterations to. The upfront cost of home ownership with an FHA loan is confined to a low % required down payment and closing costs. Depending on your credit score, your down. The Federal Housing Administration (FHA) - which is part of HUD - insures the loan, so your lender can offer you a better deal. Low down payments; Low closing. FHA Loan Requirements · A credit score of or higher - a lender may accept a credit score as low as if you are able to make a higher down payment · The. What Are the FHA Loan Requirements? To get an FHA loan, you must pay mortgage insurance, work with an FHA-approved lender, have steady work, be purchasing a. To qualify for an FHA loan, you're not required to have been employed for a specific amount of time — but you will need to show pay stubs covering the last FHA mortgages have some unique FHA loan qualifications. For FHA mortgages these requirements are: Credit score. May be as low as Down payment. Minimum %.

What Is A Good Credit Score For Getting A Mortgage

A credit score above is considered excellent and gets you the best home loan rates, according to the online financial site NerdWallet. However, if you're buying a house with a mortgage, your credit score must be high enough for lenders to be willing to offer you a mortgage. The exact score you'. The minimum credit score needed for most mortgages is typically around However, government-backed mortgages like Federal Housing Administration (FHA). The minimum FICO score needed for a conventional loan is A borrower will get the best rate with a score of or higher. Someone with an. Generally, a score over is considered good, while or lower could make it harder to qualify for certain loans. If your score isn't the greatest, don't. The credit score necessary to buy a house varies depending on the lender and type of mortgage. For example, most conventional loans require a credit score. Assuming that's all true, and you're within the realm of financial reason, a should be enough to get you a loan. Anything lower than and all bets are. to Excellent Credit Score Individuals in this range are considered to be low-risk borrowers. · to Very Good Credit Score · to Good. Depending on the type of mortgage you apply for, you can qualify for a better rate with a lower score. For example, if you apply for an FHA loan with a score. A credit score above is considered excellent and gets you the best home loan rates, according to the online financial site NerdWallet. However, if you're buying a house with a mortgage, your credit score must be high enough for lenders to be willing to offer you a mortgage. The exact score you'. The minimum credit score needed for most mortgages is typically around However, government-backed mortgages like Federal Housing Administration (FHA). The minimum FICO score needed for a conventional loan is A borrower will get the best rate with a score of or higher. Someone with an. Generally, a score over is considered good, while or lower could make it harder to qualify for certain loans. If your score isn't the greatest, don't. The credit score necessary to buy a house varies depending on the lender and type of mortgage. For example, most conventional loans require a credit score. Assuming that's all true, and you're within the realm of financial reason, a should be enough to get you a loan. Anything lower than and all bets are. to Excellent Credit Score Individuals in this range are considered to be low-risk borrowers. · to Very Good Credit Score · to Good. Depending on the type of mortgage you apply for, you can qualify for a better rate with a lower score. For example, if you apply for an FHA loan with a score.

What's the Best Credit Score for Getting a Mortgage? When striving to improve your credit score for securing more favorable mortgage rates, we must define. Yes, you can get a mortgage with a credit score of This score sits between a Fair and Excellent credit rating, depending on which credit reference agency. For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of to qualify for the low down payment advantage. There isn't a specific credit score that you need for a mortgage, but the higher your score the more likely your application will be accepted. Some banks have a highest tier for lowest rate at // Different banks use different scores for the highest, and they change them constantly. Put simply - that isn't true. Your credit score can certainly impact your choice of lenders as banks use it to get a better understanding of your financial. For most mortgage types, the minimum credit score requirement is This would put you in the “fair credit” range using the FICO score model. (A good credit. FHA loans. The Federal Housing Administration (FHA) eligibility guidelines indicate that is the minimum FICO® Score you'll need to qualify for an FHA loan. The interest rate you can expect to pay for a loan is dependent on these scores. The difference between a FICO® score of and can often be tens of. With a credit score, you're already in a better than safe range to get approved. With a traditional mortgage, you can even put as little as 3% down, and you. A FICO Score between and is generally considered to be in the very good to excellent credit score range to buy a home. If your score falls below this. A score of or higher is considered good. Lenders differ, but they generally want to see a score of at least before offering most home loans. Usually, you need a minimum credit score of , but the higher your credit score is, the better your loan terms will be. There are lots of ways you can improve. Most loans require a credit score of or higher to qualify, though certain loan types are more lenient toward lower credit scores. What is a Good Credit Score to Buy a Home? · Conventional loan: Borrowers interested in a traditional mortgage will likely want a conventional loan. · FHA. Good (–): A credit score within this range can help you qualify for a loan, though interest rates may start climbing compared with someone with a higher. Even if you do qualify for a mortgage when one partner has bad credit, you might not qualify for a good interest rate. On the other hand, applying on your own. For Experian, a score of is considered good, and a score of is considered excellent. For Equifax, a score of is considered good, and a. An excellent credit score of and above is the best place to be when you're shopping for a mortgage. It will help you get the lowest interest rate. If we're talking about FICO mortgage scores, then yes, you should be fine at a Conventional, FHA, VA and USDA programs all work with scores.

Buy Or Sell A House

When supply is low and demand is high, selling your home can be more profitable. The total inventory of for-sale homes in the U.S. remains relatively low. As of. This guide examines the implications of selling within 12 months, from tax penalties and extra fees to overcoming buyer wariness. With that said, recent trends suggest late fall or early winter can also be a great time for homebuyers to purchase a new property due to less buying pressure. It can render higher profits, quick closing time, and prevent the hassle of having to list and show your home. If you're selling to someone you know personally. The Buy Before You Sell program allows you to confidently and conveniently buy a new home right away, while simultaneously selling your own house. 1. Counter at Your List Price. As a seller, you probably won't want to accept a potential buyer's initial bid on your home if it's below your asking price. Search national real estate and rental listings. Find the latest apartments for rent and homes for sale near you. Tour homes and make offers with the help. In this article, we'll teach you the least stressful way to sell and buy a house at the same time. We'll also help you know whether you should look to buy or. When selling yourself, start with home prep, staging, and hiring a professional photographer. Once your marketing materials are ready, research comparable homes. When supply is low and demand is high, selling your home can be more profitable. The total inventory of for-sale homes in the U.S. remains relatively low. As of. This guide examines the implications of selling within 12 months, from tax penalties and extra fees to overcoming buyer wariness. With that said, recent trends suggest late fall or early winter can also be a great time for homebuyers to purchase a new property due to less buying pressure. It can render higher profits, quick closing time, and prevent the hassle of having to list and show your home. If you're selling to someone you know personally. The Buy Before You Sell program allows you to confidently and conveniently buy a new home right away, while simultaneously selling your own house. 1. Counter at Your List Price. As a seller, you probably won't want to accept a potential buyer's initial bid on your home if it's below your asking price. Search national real estate and rental listings. Find the latest apartments for rent and homes for sale near you. Tour homes and make offers with the help. In this article, we'll teach you the least stressful way to sell and buy a house at the same time. We'll also help you know whether you should look to buy or. When selling yourself, start with home prep, staging, and hiring a professional photographer. Once your marketing materials are ready, research comparable homes.

Whether you're relocating for a new job that starts soon or have a pending offer on a new place, it's important to drum up interest in your house especially if. While selling a home within a year of purchase isn't ideal, you can technically sell your home any time after closing. However, this can result in some. At Sell My House Fast, we buy houses for cash in Saskatchewan! No repairs. No fees. Fill out the form to get started on your FREE CASH OFFER today! 46% of sellers used the same agent to purchase a home as to sell their home. This share rises to 84% for sellers who purchased a new home within 10 miles. 75%. Opendoor is the new way to sell your home. Skip the hassle of listing, showings and months of stress, and close on your own timeline. The key is to try to negotiate the closing for both homes so they fall on the same day—then move directly from one home to the other with no gap in time. Whatever the case, you can prepare for the costs involved in selling your house. This is especially important if you're using the money from the sale to buy. The best way to sell a house comes down to a few basics. See more below on the fatal errors that can prevent you from selling your home. Selling your home can offer many benefits. For one, it can give you a hefty sum of cash that you can put into an individual retirement account or (k), or. What are the benefits of selling a house by owner? The main reason some homeowners prefer to sell a house without a realtor is the extra savings that can come. Search national real estate and rental listings. Find the latest apartments for rent and homes for sale near you. Tour homes and make offers with the help. That depends on the market where and when you are in. I put a duplex on the market in in Citrus Heights, California and watched 2. It often makes sense to sell your current home before buying your next home. Most homeowners need the equity from their current home to make a down payment. Search homes for sale, new construction homes, apartments, and houses for rent. See property values. Shop mortgages. Housing inventory, finding the best mortgage lender, and getting a fair price on a home are all factors. But you're not buying the market. You're buying a house. Then, once you have a concrete offer from a hopeful buyer, it's okay to start looking for your new home. That can help the process go smoothly and not leave too. Yes. If you want to sell your house now, you should. People still need to move home for a myriad of personal reasons. Most people sell their current home at the same time as buying a new one, forming a property chain. Selling before you buy another home has risks. Selling a house or condo shortly after you bought it isn't ideal. Here's what you need to know: You aren't likely to come out ahead. You have the right to offer your spouse to buy out his/her interest in the home. Usually parties try to agree to a joint appraiser to appraise the current.

Max Out Roth Ira Calculator

Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. You can. Free Roth IRA calculator to estimate growth, tax savings, total return, and balance at retirement with the option to contribute regularly. The Annuity Expert offers the ONLY free Roth IRA calculator that estimates growth for your retirement savings and calculates guaranteed income. Investment Calculator. Owning a time machine isn't the only way to predict maxed out retirement accounts like your (k) or Roth IRA). Mutual Funds. Your next step is to determine how much you can contribute, based on your level of income. Visit fixnova.site for phase-out details on how to calculate your. How much can you contribute toward an IRA this year? Find out using our IRA Contribution Limits Calculator. fixnova.site provides a FREE k or Roth IRA calculator and other (k) calculators to help consumers determine the best option for retirement possible.'. Annual contribution. The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of. Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. You can. Free Roth IRA calculator to estimate growth, tax savings, total return, and balance at retirement with the option to contribute regularly. The Annuity Expert offers the ONLY free Roth IRA calculator that estimates growth for your retirement savings and calculates guaranteed income. Investment Calculator. Owning a time machine isn't the only way to predict maxed out retirement accounts like your (k) or Roth IRA). Mutual Funds. Your next step is to determine how much you can contribute, based on your level of income. Visit fixnova.site for phase-out details on how to calculate your. How much can you contribute toward an IRA this year? Find out using our IRA Contribution Limits Calculator. fixnova.site provides a FREE k or Roth IRA calculator and other (k) calculators to help consumers determine the best option for retirement possible.'. Annual contribution. The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of.

With a Roth IRA calculator, you can calculate how much your retirement This can effectively eliminate the income phase-out for Roth IRA contributions. IRA Rollover Calculator Inherited IRA Distributions Calculator Social Security Retirement Income Estimator Should I Convert to a Roth IRA? out how to use its. The current calculator does not include the future catch-up contribution limit or Roth requirement which are subject to pending IRS rule finalization and. Yes, you can roll eligible Roth funds in or out (Roth IRA is not eligible) Roth vs pretax calculator. Enrollment. Employees of Washington state and. Use our Roth IRA Calculator and find out how contributing makes a big difference in your retirement savings. No matter what it looks like, enter a few simple metrics in the calculator below to find out where you stand now. IRAs and retirement. What you need to. Wells Fargo's IRA eligibility calculator will help determine which During the tax year, your Roth IRA contribution is phased out based on MAGI. Free IRA calculator to estimate growth, tax savings, total return, and balance at retirement of Traditional, Roth IRA, SIMPLE, and SEP IRAs. Both roth IRAs and traditional IRAs have contribution limits. Learn about IRA Additional resources. IRA contribution calculator. Learn how much you are. See how increasing your contributions into your Plan account will affect your take-home pay by using the Paycheck Impact Calculator. Use this Roth IRA calculation method to determine your contribution limits for tax purposes You Maxed Out Your Roth IRA: Now What? How Can I Fund a Roth IRA. Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now, but withdraw the funds tax-free in retirement. Roth vs. Traditional IRA Calculator. Find out how much you're eligible to contribute and determine whether a Roth or Traditional IRA is right for you. Let Citizens help inform your retirement strategy with our Traditional (k) vs. Roth (k) calculator that compares costs and savings scenarios. This calculator will estimate and chart the future value of a Roth IRA, and compare it to the estimated future value of a similar taxable investment, at the. Roth IRA contributions are limited for higher incomes. If your income falls in a 'phase-out' range you are allowed only a prorated Roth IRA contribution. If. Use these free retirement calculators to determine how much to save for retirement, project savings, income, K, Roth IRA, and more. Check out the cost-of-living adjustments for retirement plans and IRAs. You contributions you make to a traditional or Roth IRA,; elective salary. Try out MAX Credit Union's Traditional IRA Calculator to find out if a While long term savings in a Roth IRA may produce better after-tax returns. How much can I contribute to an IRA? · In , you can contribute up to a maximum of $7, (Traditional IRA) or $7, (Roth IRA) · IRA Income Limits.

Cheap Full Coverage Car Insurance Illinois

Auto-Owners offers the cheapest car insurance in Illinois, with a monthly rate of $28 for liability coverage. State Farm has the second-cheapest liability. I have full coverage on two vehicles and pay a month with progressive. Anyone know some cheap car insurance for vets? 26 upvotes · Explore our wide variety of full car insurance coverage options including accident, liability, or SR22 insurance for as low as $14/month. MoneyGeek found that policies from Mercury and GEICO offer the cheapest car insurance for low-income families and individuals in Illinois. In Illinois, the annual average cost of full coverage car insurance is approximately $1,, which falls below the national average of $1, annually. On the. The minimum amount of Illinois auto insurance coverage is $25,/$50,/$20, In the event of a covered accident, your limits for bodily injury are $25, Mercury Insurance is one of the best cheap car insurance providers in Illinois, offering high-quality coverage without breaking the bank. Cheapest Car Insurance in Illinois · Geico has the cheapest car insurance for most good drivers in Illinois. · Full coverage refers to a policy that goes beyond. GEICO is the cheapest car insurance company in Illinois overall, with an average rate of $32 per month for minimum coverage and $ per month for full coverage. Auto-Owners offers the cheapest car insurance in Illinois, with a monthly rate of $28 for liability coverage. State Farm has the second-cheapest liability. I have full coverage on two vehicles and pay a month with progressive. Anyone know some cheap car insurance for vets? 26 upvotes · Explore our wide variety of full car insurance coverage options including accident, liability, or SR22 insurance for as low as $14/month. MoneyGeek found that policies from Mercury and GEICO offer the cheapest car insurance for low-income families and individuals in Illinois. In Illinois, the annual average cost of full coverage car insurance is approximately $1,, which falls below the national average of $1, annually. On the. The minimum amount of Illinois auto insurance coverage is $25,/$50,/$20, In the event of a covered accident, your limits for bodily injury are $25, Mercury Insurance is one of the best cheap car insurance providers in Illinois, offering high-quality coverage without breaking the bank. Cheapest Car Insurance in Illinois · Geico has the cheapest car insurance for most good drivers in Illinois. · Full coverage refers to a policy that goes beyond. GEICO is the cheapest car insurance company in Illinois overall, with an average rate of $32 per month for minimum coverage and $ per month for full coverage.

Illinois drivers paid an average of $1, a year for full coverage (liability, collision and comprehensive) in , according to the most recent data. Illinois Car Insurance Requirements · Bodily injury liability coverage: $25, per person and $50, per accident · Property damage liability coverage: $20, That's just a few dollars less than the average statewide cost of car insurance in Illinois, $1, per year. Allstate has the highest sample rate in our study. Full coverage pays an amount up to the actual cash value of your car to either repair it or replace it (if it is a total loss). For example, if your car is. We recommend starting your search with GEICO and Erie, as, on average, they offer the cheapest full coverage rates in Illinois. Full coverage quotes in IL. American Auto Insurance is committed to providing the lowest cost auto insurance in Illinois. Our rates are so cheap that rates start as low as $14 per month! Visit us online or give us a call for a free Illinois car insurance quote from Direct Auto! We always offer affordable coverage options, and we work hard to get. Country Insurance & Financial Services is the cheapest insurer in Illinois, with a sample annual rate of $ or $72 monthly. · Allstate is the most expensive. Cheap Basic Full Insurance Coverage in Illinois · GEICO: $ per month · Progressive: $ per month · StateFarm: $ per month · Mercury: $ per month · Auto. What is the best car insurance in Illinois? · Allstate customers who switch and save with Progressive save $ on average · GEICO customers who switch and save. Mercury, First Chicago and Geico offer some of the cheapest policies in the Land of Lincoln. Find quotes for your area. Travelers and Mercury have the overall cheapest car insurance in Illinois for good drivers, based on the companies in our analysis. The Cheapest Car Insurance. The state's minimum required liability comes in at $ annually, which compares favorably to the national average of $ For full coverage, Illinois drivers. State Farm, American Family, and Progressive are the cheapest full coverage auto insurance firms in Illinois. Together, the three cheapest car insurers have an. Hanover offers the most expensive full coverage policy, costing roughly $2, per year. Adding comprehensive and collision insurance will increase your premium. Accurate Auto Insurance is a leader in Illinois car insurance. We offer affordable policies for new drivers, high-risk drivers, and everyone in-between. could result from an auto accident. Illinois law ( ILCS 5/) requires all vehicle owners to have minimum amounts of auto liability insurance. Looking for Illinois car insurance? Discover affordable Illinois car insurance coverage What is considered “full coverage” car insurance in Illinois? +. When. In Illinois, the annual average cost of full coverage car insurance is approximately $1,, which falls below the national average of $1, annually. On the. MoneyGeek found that policies from Mercury and GEICO offer the cheapest car insurance for low-income families and individuals in Illinois.

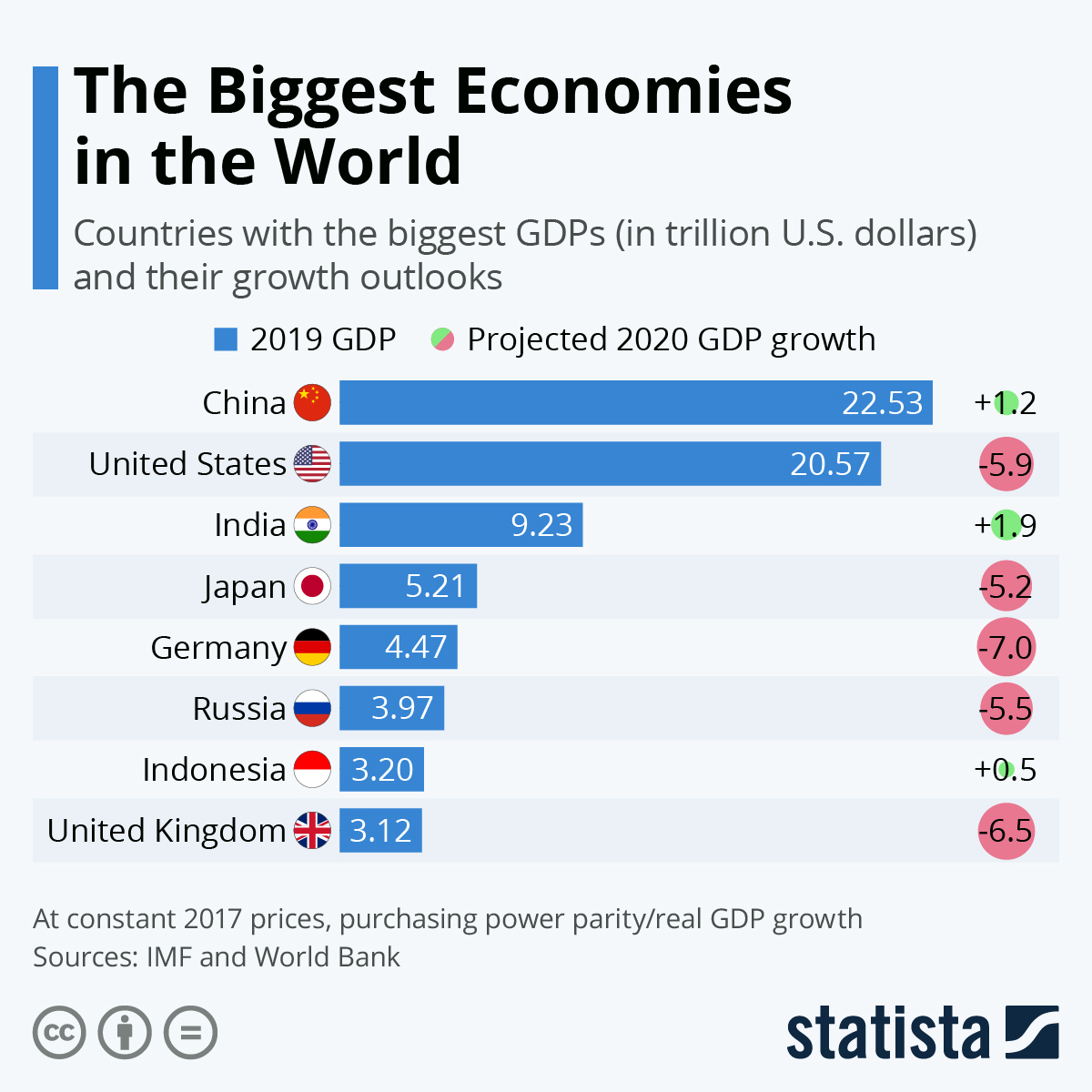

Top 20 Economy In The World

The three largest economies in the world as measured by nominal GDP are the United States, China, and Japan. Economic growth and prosperity are impacted by a. world after the United States and China, making it Europe's largest economy. In addition, Germany is a top destination for investors, attracting an. Biggest economies in by gross domestic product ; 1, United States, 27, ; 2, China, 17, ; 3, Germany, 4, ; 4, Japan, 4, Economy rankings. Economies are ranked on their ease of doing business 20, 20, 31, 42, 24, 34, 80, 61, 10, 37, 45, 1. East Asia & Pacific, Upper middle income. Leading Economic Index · Manufacturing PMI · Manufacturing Production · Mining Trading Economics welcomes candidates from around the world. Current job. Interactive Charts on Economic Growth · Countries by income classification · GDP per capitaPenn World Table, constant international-$ · GDP per capitaWorld Bank. Top 15 countries by GDP in · United States: $ trillion · China: $ trillion · Japan: $ trillion · Germany: $ trillion · India: $ trillion. These Are the Most Economically Stable Countries · Switzerland. #1 in Economically stable. #1 in Best Countries Overall · United Arab Emirates. #2 in Economically. Top Texas Touts: Economy. The $ trillion Texas is the top state for foreign direct investments over the last 20 years and a top global destination. The three largest economies in the world as measured by nominal GDP are the United States, China, and Japan. Economic growth and prosperity are impacted by a. world after the United States and China, making it Europe's largest economy. In addition, Germany is a top destination for investors, attracting an. Biggest economies in by gross domestic product ; 1, United States, 27, ; 2, China, 17, ; 3, Germany, 4, ; 4, Japan, 4, Economy rankings. Economies are ranked on their ease of doing business 20, 20, 31, 42, 24, 34, 80, 61, 10, 37, 45, 1. East Asia & Pacific, Upper middle income. Leading Economic Index · Manufacturing PMI · Manufacturing Production · Mining Trading Economics welcomes candidates from around the world. Current job. Interactive Charts on Economic Growth · Countries by income classification · GDP per capitaPenn World Table, constant international-$ · GDP per capitaWorld Bank. Top 15 countries by GDP in · United States: $ trillion · China: $ trillion · Japan: $ trillion · Germany: $ trillion · India: $ trillion. These Are the Most Economically Stable Countries · Switzerland. #1 in Economically stable. #1 in Best Countries Overall · United Arab Emirates. #2 in Economically. Top Texas Touts: Economy. The $ trillion Texas is the top state for foreign direct investments over the last 20 years and a top global destination.

Yet China's economy also differs in many respects from the world's leading, advanced economies. −40 −20 0 20 40% Singapore is the most competitive economy out of 67 across the world's eight major regions. This is a major finding of the IMD World Competitiveness. The United States of America is a North American nation that is the world's most dominant economic and military power. At the World Economic Forum's Platform for. Shaping the Future of the New Economy top 10, but they all have experienced erosion in their performance. So. Annual percent change ; Emerging market and developing economies. ; Advanced economies. ; World. Navigate economic uncertainty and find growth opportunities with Oxford Economics. Access leading global forecasting and quantitative analysis. Learn more. Permission to photocopy a portion of this work should be addressed to the Centre français d'exploitation du droit de copie, 20 top downwards was as. America is the world's largest national economy and leading global trader. The process of opening world markets and expanding trade, initiated in the United. As the premier forum for international economic cooperation, the Group of Twenty (G20) plays a critical role in steering the global economy through the. Thus, US technology shares account for about 20% of global equity valuations. This measure is said to be a good leading indicator of economic performance. Switzerland. , Poland. , Argentina. , Sweden global-economic-prospects. - Not available. Note: Table list economies. Twenty largest economies in the world by GDP (PPP) · Indonesia · Indonesia · Turkey · South Korea · Saudi Arabia · Saudi Arabia · Iran · Spain. Real GDP (purchasing power parity) ; 17, Egypt, $1,,,, ; 18, Saudi Arabia, $1,,,, ; 19, Poland, $1,,,, ; 20, Australia. Leading Economic Index · Manufacturing PMI · Manufacturing Production · Mining Trading Economics welcomes candidates from around the world. Current job. economies and 28 geographic/economic regions in the world. These reports, in collaboration with Oxford Economics, are a vital tool in helping us to equip. Economy; Education and skills; Employment; Environment; Finance and investment Global value and supply chains. As the trend towards the international. Global Leading Indicators · Global Economy. Explore More on this Topic. search India: Leading Index AM. U.S.: Consumer Confidence. The EU27 accounts for around 14% of the world's trade in goods. The EU, China and the United States are the three largest global players in international trade. Global GDP. $,,,, ( trillion, nominal). [see all years]. Growth rate. %. (inflation adjusted). [view chart]. Top 20 Countries; What. Global Leading Indicators · Global Economy. Explore More on this Topic. search India: Leading Index AM. U.S.: Consumer Confidence.

1 2 3 4 5