fixnova.site

Market

Ira Plan Definition

Individual retirement accounts (IRAs) are personal retirement savings accounts that offer tax benefits and a range of investment options. A Roth IRA is an individual retirement account, or IRA, that you contribute to outside your workplace plan and from which you can make tax-free withdrawals. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis. Individual Retirement Account (IRA) - A personal retirement plan that permits yearly income contributions and offers tax benefits. IRA, Roth IRA, SEP IRA, or other tax-deferred retirement accounts. ▫ (k), a, b, , or other non-federal defined contribution plans. ▫ Not. A SIMPLE IRA plan provides you and your employees with an easy way to contribute toward retirement. It reduces taxes and also helps you attract and retain. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. An IRA (individual retirement account) is a personal, tax-deferred account the IRS created to give investors an easy way to save for retirement. An individual retirement account (IRA) is a tax-advantaged investment account designed to help you save toward retirement. Individual retirement accounts (IRAs) are personal retirement savings accounts that offer tax benefits and a range of investment options. A Roth IRA is an individual retirement account, or IRA, that you contribute to outside your workplace plan and from which you can make tax-free withdrawals. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis. Individual Retirement Account (IRA) - A personal retirement plan that permits yearly income contributions and offers tax benefits. IRA, Roth IRA, SEP IRA, or other tax-deferred retirement accounts. ▫ (k), a, b, , or other non-federal defined contribution plans. ▫ Not. A SIMPLE IRA plan provides you and your employees with an easy way to contribute toward retirement. It reduces taxes and also helps you attract and retain. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. An IRA (individual retirement account) is a personal, tax-deferred account the IRS created to give investors an easy way to save for retirement. An individual retirement account (IRA) is a tax-advantaged investment account designed to help you save toward retirement.

An IRA is a tax-deferred account used save and grow money for retirement. Several different types exist, each with different features and tax implications. SIMPLE IRA, which stands for Savings Incentive Match Plan for Employees Individual Retirement Accounts, is employer-sponsored. This means it is offered to. Savers contribute a portion of each paycheck to an Individual Retirement Account (IRA) that belongs to them. Each saver decides how much to contribute and. A SIMPLE IRA is similar to a (k) plan. The contributions made to this plan are with pre-tax dollars, and the money grows tax-deferred in the plan until the. A SIMPLE IRA plan (Savings Incentive Match PLan for Employees) allows employees and employers to contribute to traditional IRAs set up for employees. If you're looking for an easy way to set up a retirement program for your employees, a SIMPLE IRA (Savings Incentive Match Plan) could be the right choice. A defined benefit plan promises a specified monthly benefit at retirement. IRA plans. SEP Retirement Plans for Small Businesses (PDF) - Describes an. An individual retirement account (IRA) is a tax-advantaged way to boost your retirement savings. As an extra benefit, your investment choices might be more. A qualified plan is one that qualifies to receive certain tax benefits as described in Section of the U.S. tax code. Here are the types of qualified plans. Individual Retirement Accounts (IRA) provide tax advantages for retirement savings. You can contribute each year up to the maximum amount allowed by the. An Individual Retirement Account (IRA) is a retirement savings account set up with a financial institution or brokerage firm that offers tax breaks. SEP IRA; Personal Defined Benefit Plan. Overview · FAQs · SIMPLE IRA · Business (k) Plan · Company Retirement Account · Accounts by Financial Goal · Open an. An IRA, which stands for an individual retirement account, is a personal savings plan that offers certain tax advantages. A Roth IRA is a newer take on a traditional IRA, and it offers substantial tax benefits. Contributions to a Roth IRA are made with after-tax money, meaning you'. A Roth IRA is a special individual retirement account (IRA) where you pay taxes on money going into your account, and then all future withdrawals of earnings. With a Roth IRA (Individual Retirement Account), you make after-tax contributions to save and grow your retirement investments tax-deferred. Contributions to (a) plans are tax-deferred, meaning that contributions grow tax-free until withdrawn in retirement when the funds are taxed as ordinary. An Individual Retirement Account (IRA) is a self-funded and self-managed savings or investment account that can help you to accumulate more wealth for your. An IRA, or Individual Retirement Account, is a tax-advantaged savings plan for individuals, small businesses, and the self-employed.

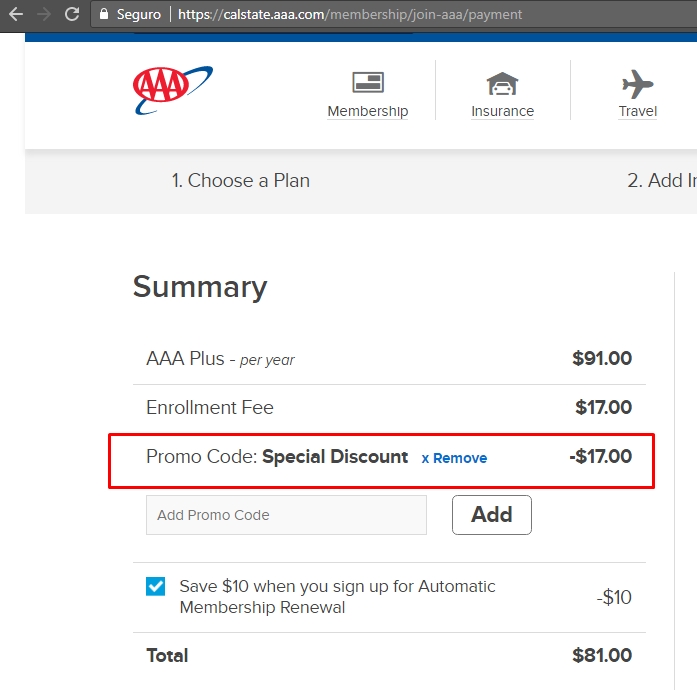

Aaa Plus Promo Code

Join today and add a family member for FREE! Two memberships for the price of one plus AAA security and savings. Exclusive offer with your AAA or CAA membership, use promo code PAAH and receive 15% off plus a $50 food & beverage credit when you book your stay at. Save with one of our top AAA Coupons for August 50% Off. Discover 28 tested and verified AAA Promo Code, courtesy of Groupon. AAA member number or full name and zip code. I have multiple lines on my Not valid for existing reservations, or with any other promotion, offer, discount or. AAA Members Save Up to 15%. Take advantage of your AAA membership and save on your Dollar car rental. When you use your AAA club discount code you save and. Save with 86 Active AAA promo codes and coupons. Find the best AAA discount codes and deals from BrokeScholar. Get a year of benefits, including over $ in savings and a FREE Associate membership! Join AAA today and save. Deal · Order An Auto Renewal Membership, Get 50% off Additional Memberships. · Deal · Save 10% on Auto Repair. · Deal · Save on Memberships in 7 Different States. The Latest Discount Offers ; NAPA Auto Parts. Save 20% ; 1 Auto Center Corp. Save at this AAA Approved Repair facility. ; Lighting. Save 20% On Kuzco. No Code. Join today and add a family member for FREE! Two memberships for the price of one plus AAA security and savings. Exclusive offer with your AAA or CAA membership, use promo code PAAH and receive 15% off plus a $50 food & beverage credit when you book your stay at. Save with one of our top AAA Coupons for August 50% Off. Discover 28 tested and verified AAA Promo Code, courtesy of Groupon. AAA member number or full name and zip code. I have multiple lines on my Not valid for existing reservations, or with any other promotion, offer, discount or. AAA Members Save Up to 15%. Take advantage of your AAA membership and save on your Dollar car rental. When you use your AAA club discount code you save and. Save with 86 Active AAA promo codes and coupons. Find the best AAA discount codes and deals from BrokeScholar. Get a year of benefits, including over $ in savings and a FREE Associate membership! Join AAA today and save. Deal · Order An Auto Renewal Membership, Get 50% off Additional Memberships. · Deal · Save 10% on Auto Repair. · Deal · Save on Memberships in 7 Different States. The Latest Discount Offers ; NAPA Auto Parts. Save 20% ; 1 Auto Center Corp. Save at this AAA Approved Repair facility. ; Lighting. Save 20% On Kuzco. No Code.

Fun fact if you already have AAA there's a promo code you can use Don't be dramatic, cancel the AAA membership and AAA will refund you the. Free Membership for Teen Drivers with This AAA Promo Code. 85 People Used. 80 Only 54 Plus A Second Member Free (Memberships). 40 People Used. -$ Code. Book Now. powered by Travel Tripper. AAA Member Rate. NoMo SoHo Deals. AAA Must provide AAA membership card at check-in. Book Now. Similar Events. To take advantage of this special member promotion, be sure to enter the promo code AAACPA during the checkout process. BROWSE ALL PRODUCTS. CHECK THESE OUT! discounts & rewards. Find member savings on shopping, dining, travel, entertainment and more! Restaurants · Theme Parks · Automotive · Sports & Recreation. Get a 1-Year Basic membership for two for only $ per month*! Use promo code MT Get additional associates for half price, only $21 each. As a AAA Member. Get $35 off with a AAA promo code from fixnova.site AAA promotion codes for new customers and renewals including enrollment fee waivers. Get your first year for just $54! Use Promo CodeAAASAVE Offer valid through 12/31/24 for new Basic memberships only in Hennepin County, Columbia Heights. 50% off additional memberships with Automatic Renewal at AAA! 50%, 01 Jan. Get $50 off Tire and Wheel Protection Plan with the AAA Plus Membership. $50, Always. AAA Coupons and Discount Codes August · 30% off membership: The best AAA coupon code is AMUSE Added 20 hours ago by Nick via social media. [+] Show. Save at AAA with 23 active coupons & promos verified by our experts. Choose the best offers & deals starting from 10% to 50% off for August ! August AAA Promo Codes | PLUS earn a 5% bonus | Save an average of $35 | Use one of our 11 best coupons | Offers hand tested on 8/26/ This promotion offers a Basic Primary Membership for $ and 2 Basic Associate Memberships free. For those electing Plus or Premier Membership, a Primary. Save yourself time and money with these free fixnova.site promo codes & discounts at fixnova.site, every time you shop! AAA Membership Starting at $/Year · Used Times ; Up to $ Car and Home Locksmith Reimbursement · Used Times ; Get 24/7 Roadside Assistance in. 12+ active AAA Promo Codes, Discount Codes & Deals for Aug Most popular: $47 Off Membership Plan with AAA Promo Code: DRIVE***** from DontPayFull. AAA/CAA CDP#'s ; AAA Alabama, ; AAA Arizona, 2 ; Automobile Club of. Southern California, 4 ; AAA Northern California, Nevada & Utah, 5 ; AAA Colorado, 6. Exclusive offer with your AAA or CAA membership, use promo code PAAH and receive 15% off plus a $50 food & beverage credit when you book your stay at Claremont. To receive discounted primary membership and one free associate membership, use Promotional Code “AAASAVE” at checkout. Offer applies to the first ("Primary"). Receive AAA Membership Plus for only $91/yr when you use this coupon. · Get AAA Classic Membership for just $56/year when you activate this AAA coupon. · Apply.

How To Pay No Taxes

How Not to Pay Taxes: Four Legal Ways to Not Pay US Income Tax · 1. Live Outside the United States · 2. Live Nomadically to Benefit from Offshore Tax Incentives. McCulloch, the cashier of the Baltimore branch of the bank, refused to pay the tax “The State governments have no right to tax any of the constitutional means. 6 Strategies to Lower Your Tax Bill · Invest in municipal bonds. · Shoot for long-term capital gains. · Start a business. · Max out retirement accounts and employee. The terms of the payment plan require you file and pay all tax returns on time in addition to making the expected payments. · We will continue to intercept any. fixnova.site: How to Pay Zero Taxes, Your Guide to Every Tax Break the IRS Allows: Schnepper, Jeff A.: Books. Not everyone is required to file or pay taxes. Depending on your age, filing status, and dependents, for the tax year, the gross income threshold for. The best way to pay little to no taxes is to make your income equal your standard deductions or itemized deductions. Are married and file a separate tax return, you probably will pay taxes on your benefits. Then choose the year for any of the past 6 years for which. Contribute to a (k) or traditional IRA One of the easiest and most beneficial ways to reduce your taxable income is to contribute to a pre-tax retirement. How Not to Pay Taxes: Four Legal Ways to Not Pay US Income Tax · 1. Live Outside the United States · 2. Live Nomadically to Benefit from Offshore Tax Incentives. McCulloch, the cashier of the Baltimore branch of the bank, refused to pay the tax “The State governments have no right to tax any of the constitutional means. 6 Strategies to Lower Your Tax Bill · Invest in municipal bonds. · Shoot for long-term capital gains. · Start a business. · Max out retirement accounts and employee. The terms of the payment plan require you file and pay all tax returns on time in addition to making the expected payments. · We will continue to intercept any. fixnova.site: How to Pay Zero Taxes, Your Guide to Every Tax Break the IRS Allows: Schnepper, Jeff A.: Books. Not everyone is required to file or pay taxes. Depending on your age, filing status, and dependents, for the tax year, the gross income threshold for. The best way to pay little to no taxes is to make your income equal your standard deductions or itemized deductions. Are married and file a separate tax return, you probably will pay taxes on your benefits. Then choose the year for any of the past 6 years for which. Contribute to a (k) or traditional IRA One of the easiest and most beneficial ways to reduce your taxable income is to contribute to a pre-tax retirement.

You file a federal return;; You want to claim a refund of any New Mexico state income tax withheld from your pay, or; You want to claim any New Mexico rebates. Are married and file a separate tax return, you probably will pay taxes on your benefits. Then choose the year for any of the past 6 years for which. You are required to submit either payment of tax or proof that no tax is due before your vehicle can be titled. Individual Income Tax rates range from 0% to a top rate of 7% on taxable income. Tax brackets are adjusted annually for inflation. DEDUCTIONS. • You do not pay. File an extension: No matter your income, you can file an extension with a trusted IRS Free File partner. You must estimate and pay the tax you owe and file by. When you pay more taxes (i.e., withholding taxes or estimated taxes) than no Massachusetts sales tax (or less than %) was paid. Unlike the Taxpayers may pay their tax in a variety of ways: Use funds in the form of a personal check, money order or cashier's check. Most low-income households do not pay federal income taxes, typically because they owe no tax (as their income is lower than the standard deduction) or because. If you don't take the deduction, you'll pay more tax than you owe. If you make any use of property you purchased for resale other than demonstration or. Contribute to a (k) or traditional IRA One of the easiest and most beneficial ways to reduce your taxable income is to contribute to a pre-tax retirement. fixnova.site: How to Pay Zero Taxes, Your Guide to Every Tax Break the IRS Allows: Schnepper, Jeff A.: Books. tax on the repair costs – both materials and labor – if the out-of-state vendor is not registered to collect Iowa tax and if no tax is paid to the other state. Amazon paid little in taxes despite having high financial accounting income (especially in ) for several reasons. Overall: ○ Some years billionaires pay no federal income taxes: Jeff Bezos paid zero in and , Elon. Musk paid zero in The IRS will bill you for the rest. You'll owe interest on the balance, and you might owe a late payment penalty. If you owe $50, or less in combined taxes. A penalty may be assessed on any return not filed by the due date. Filing Online. Electronic filing works in conjunction with the Internal Revenue Service's . The IRS will provide taxpayers up to days to pay their full tax balance. Fees or cost: There's no fee to request the extension. There is a penalty of %. This person is in the 15% tax bracket and so if taxed on the allowances would pay another $2, in taxes. No FEAR Act · Join the Military · DoD Careers. If you keep all your receipts, you can deduct actual sales and use tax you paid during the tax year. Deduction cap for tax years to Your deduction.

I Found A Credit Card

Find out if a balance transfer offer is available for your Wells Fargo credit card card will turn off all cards associated with your credit card account. Compare credit cards and find a Mastercard® or Visa® credit card that's best for you, whether it's Cash Back rewards, travel or rebuilding your credit. If you find your missing credit card, you can contact the card issuer at the number on the back of the card to let them know you've found it. Find the American Express credit card that is right for you or your business. Credit cards offer exceptional benefits, rewards, services and spending power that can help make your financial and personal dreams come true. Find a Credit Card. See if You're Pre-Approved · Compare All Cards · Redeem a You can report your card lost or stolen if you are missing your card or think. No credit check. SMART TAX TOOLS. No-stress taxes. Know what you owe. Found The Found Mastercard Business debit card is issued by Piermont Bank pursuant to a. Find the Mastercard® that's right for you. No card is more accepted around the world. Select a card category. But a credit reporting agency is allowed to decline to block or rescind a block if you got goods, services, or money as a result of the blocked transaction. The. Find out if a balance transfer offer is available for your Wells Fargo credit card card will turn off all cards associated with your credit card account. Compare credit cards and find a Mastercard® or Visa® credit card that's best for you, whether it's Cash Back rewards, travel or rebuilding your credit. If you find your missing credit card, you can contact the card issuer at the number on the back of the card to let them know you've found it. Find the American Express credit card that is right for you or your business. Credit cards offer exceptional benefits, rewards, services and spending power that can help make your financial and personal dreams come true. Find a Credit Card. See if You're Pre-Approved · Compare All Cards · Redeem a You can report your card lost or stolen if you are missing your card or think. No credit check. SMART TAX TOOLS. No-stress taxes. Know what you owe. Found The Found Mastercard Business debit card is issued by Piermont Bank pursuant to a. Find the Mastercard® that's right for you. No card is more accepted around the world. Select a card category. But a credit reporting agency is allowed to decline to block or rescind a block if you got goods, services, or money as a result of the blocked transaction. The.

If you can't find your card after locking it, contact your issuer or bank to report your lost or stolen card. Remember not to wait too long — if you take longer. The Truth in Lending Act prohibits a bank from issuing credit cards except in response to an oral or written request or application for the card. Finding your card's security code. With most credit card networks, including Discover, Mastercard and Visa, you'll find the security code on the back of your. > The CardToken specified could not be found. - When typing Credit Card info into a Revenue batch or Processing Payments. When entering credit card. Log in to Online Banking to report your lost or stolen credit card. You can also call (outside the continental US call international collect Answer a few quick questions to find the perfect credit card for you. We choose from of the top travel and cash rewards credit cards based on your. Get information on how to report a lost or stolen debit card or credit card How do I find my account number? What is Zelle®? How do I report a lost. card. Contact information for the largest credit card issuers can be found below. Issuer, Report by Phone, Report Online. American Express. If you have found an AIB Debit or Credit card, please drop the card into your local AIB branch, if it's convenient to do so. If not, please destroy the card. If the card is found, then the freeze can be lifted and everything goes back to normal. If it remains missing, the card company will simply deactivate the. Find a Credit Card. See if You're Pre-Approved · Compare All Cards · Redeem a Credit Card BenefitsExplore built-in card benefits. Find great deals with. If your credit, ATM, or debit card is lost or stolen, federal law limits your liability for charges made without your permission, but your protection. If you think you might find your credit card, you can temporarily lock it or reset your PIN. If your card is lost or has been stolen, you can report it to. Get The Most Out of My Credit Card · Lost or stolen cards · Lock your card temporarily · Damaged card replacement request · Find out more about our credit cards. 1. Notify the card issuer · 2. If possible, lock or temporarily disable your lost credit card · 3. Think about recurring transactions · 4. Check your future. How do I report a credit card as lost or stolen? · From the main menu select Manage cards, then choose the missing card. · Select Report card lost or stolen. · Let. The first step to reduce your losses is to review your credit card account often. At a minimum, carefully inspect your monthly statement in search of any. Compare Credit Cards · Key Cashback Credit Card · KeyBank Latitude Credit Card · Key Secured Credit Card find your card. When locked, the card can be used to. Credit cards · Identification · Car Registration · Driver's license. Guide to lost credit card. Report your missing credit card to the card issuer as soon as. Your card security code (CSC), verification code (CVC), or card code verification (CCV) can be found on the back of your card and is.

3 4 5 6 7