fixnova.site

Overview

When Should You Roll Over 401k

I recommend doing this as soon as you leave the employer that the k is associated with. Open an IRA at a major investment firm, such as Fidelity or Vanguard. When should I roll over? You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may. The short answer is yes – you can roll over your (k) while still employed at the same place. Leaving an employer isn't the only time you can move your (k). An IRA rollover (also known as IRA transfer) is a way to take your previous (k) retirement account with you, but there are tax impacts to be aware of. Depending on plan rules, if you have a low balance (less than $) your account balance may be sent to you as a taxable distribution, or may be rolled over to. How long do I have to roll over a (k) after leaving job? You can roll over an old (k) to a new one if you change jobs, but you'll need to do it within 60 days. Learn more about the process for rolling over. Rolling over a (k) is an opportunity to simplify your finances. By bringing your old (k)s and IRAs together, you can manage your retirement savings. Depending on plan rules, if you have a low balance (less than $) your account balance may be sent to you as a taxable distribution, or may be rolled over to. I recommend doing this as soon as you leave the employer that the k is associated with. Open an IRA at a major investment firm, such as Fidelity or Vanguard. When should I roll over? You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may. The short answer is yes – you can roll over your (k) while still employed at the same place. Leaving an employer isn't the only time you can move your (k). An IRA rollover (also known as IRA transfer) is a way to take your previous (k) retirement account with you, but there are tax impacts to be aware of. Depending on plan rules, if you have a low balance (less than $) your account balance may be sent to you as a taxable distribution, or may be rolled over to. How long do I have to roll over a (k) after leaving job? You can roll over an old (k) to a new one if you change jobs, but you'll need to do it within 60 days. Learn more about the process for rolling over. Rolling over a (k) is an opportunity to simplify your finances. By bringing your old (k)s and IRAs together, you can manage your retirement savings. Depending on plan rules, if you have a low balance (less than $) your account balance may be sent to you as a taxable distribution, or may be rolled over to.

Also, if you turn 55 or older the year you leave your employer, there may be tax advantages to leaving your (k) where it is, as you'll generally be able to. In a direct rollover, the funds are transferred directly from your previous employer's (k) plan to your chosen IRA or your new employer's retirement plan. By. The short answer is yes – you can roll over your (k) while still employed at the same place. Leaving an employer isn't the only time you can move your (k). You can roll over an old (k) to a new one if you change jobs, but you'll need to do it within 60 days. Learn more about the process for rolling over. Within 60 days of receiving the distribution check, you must deposit the money into a Rollover IRA to avoid current income taxes. If taxes were withheld from. A rollover is when you move the assets in an employer-sponsored retirement plan, such as a (k) or (b), into an IRA. An in-service rollover to an IRA is a retirement planning strategy that has been used by employees who value the flexibility of IRAs. There are three main. If your new employer offers a (k), you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount. (a) Rollover to Another (a). If you leave one job for another and both employers offer (a) plans, you may roll one (a) plan into another (a) plan. If your new employer's plan accepts rollovers, you can move your money to that plan without incurring current income taxes and possible additional taxes for. Rolling over your (k) to an IRA (Individual Retirement Account) is one way to go, but you should consider your options before making a decision. A Rollover IRA is a retirement account that allows you to roll money from your former employer-sponsored retirement plan into an IRA. You don't have to roll over your (k), but when you leave your money with your former employer's plan, your investment choices are limited to what's available. Direct rollovers. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without. Rolling your funds over into a new account should be easy and comes with tax advantages. But keep in mind, you'll only have 60 days to deposit the check into. A rollover is when you move the assets in an employer-sponsored retirement plan, such as a (k) or (b), into an IRA. Roll over your old (k) into an IRA as soon as possible. IRA fees are both more transparent and lower than (k) fees, you have a much wider range of. Within 60 days of receiving the distribution check, you must deposit the money into a Rollover IRA to avoid current income taxes. If taxes were withheld from. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. If you choose to rollover the (k), your funds are invested in an IRA account which offers you full control of your savings and investments.

Zimbabwe Currency 100 Trillion Dollar Note

Zimbabwe has had the surreal experience of seeing a real $ trillion dollar bill Zimbabwe, and all he got me was trillion dollars. Today, collectors around the world seek out the Trillion Dollar note like hot cakes and it has become somewhat both a collectors item and a note for. The Zimbabwean Reserve Bank printed different variants of the Trillion note, each with the same Chiremba balancing rocks on the obverse. Rare, uncirculated. The old trillion dollar notes became worthless except as souvenirs (see below). Zimbabwe Dollar Trillion Note. Zimbabwe Dollar Trillion Banknote of But trillion Zimbabwean dollars will fetch only 40 U.S. cents. That's a fraction of what collectors have been paying for the notes with numerous zeroes for. Today, collectors around the world seek out the Trillion Dollar note like hot cakes and it has become somewhat both a collectors item and a note for. YIQILAFADA 10pcs Gold Zimbabwe Trillion Dollar Bills, Gold Leaf Bills for Commemorative Banknotes Home Decoration · out of 5 stars. The Zimbabwean Dollar (ZWD) was established to replace Rhodesian Dollar and to signify the nation's independence from the UK in Zimbabwe Trillion Dollars AA P Banknote New UNC Zim Currency w/COA. $ Free shipping. Only 1 left! Zimbabwe has had the surreal experience of seeing a real $ trillion dollar bill Zimbabwe, and all he got me was trillion dollars. Today, collectors around the world seek out the Trillion Dollar note like hot cakes and it has become somewhat both a collectors item and a note for. The Zimbabwean Reserve Bank printed different variants of the Trillion note, each with the same Chiremba balancing rocks on the obverse. Rare, uncirculated. The old trillion dollar notes became worthless except as souvenirs (see below). Zimbabwe Dollar Trillion Note. Zimbabwe Dollar Trillion Banknote of But trillion Zimbabwean dollars will fetch only 40 U.S. cents. That's a fraction of what collectors have been paying for the notes with numerous zeroes for. Today, collectors around the world seek out the Trillion Dollar note like hot cakes and it has become somewhat both a collectors item and a note for. YIQILAFADA 10pcs Gold Zimbabwe Trillion Dollar Bills, Gold Leaf Bills for Commemorative Banknotes Home Decoration · out of 5 stars. The Zimbabwean Dollar (ZWD) was established to replace Rhodesian Dollar and to signify the nation's independence from the UK in Zimbabwe Trillion Dollars AA P Banknote New UNC Zim Currency w/COA. $ Free shipping. Only 1 left!

Why is the trillion dollar Zimbabwe bank note so expensive online? ; St0iK_ · Make sure they're kosher, buy all, sell on ebay, put money into. Throughout the late 90's and the 's, inflation began to spin out of control in Zimbabwe, causing the country to issue larger and larger bank notes. Why is the trillion dollar Zimbabwe bank note so expensive online? ; St0iK_ · Make sure they're kosher, buy all, sell on ebay, put money into. trillion dollar Zimbabwe on white background. · One hundred trillion Zimbabwean dollar bill, the largest at face value of all official notes in the world. This trillion dollar note is one of the world's largest denominations of currency. It was issued in Zimbabwe in during a period of hyperinflation. The Zimbabwean trillion dollar banknote is a banknote of Zimbabwe. When it was in circulation for about three months, it was the highest circulating. However, in , millions of ten, fifty and one hundred trillion dollars notes were printed. Though these notes have no currency value today, they do remain. This picture taken on July 22, shows Zimbabwe's new billion dollar note in Harare. Zimbabwe, now grappling with a record high million. Trillion Dollars · Chinese Yellow Dragon Bond Currency · 20 Francs · fixnova.site Trillion Dollar Note Zimbabwe · Ml@ Mgrby@. Listed on Jun 1, 4. The Zimbabwean currency has lost its worth. People do not have faith in it any more. What does that mean? Let's revisit the basics first. I Zimbabwe 5 Billion Dollars Inflation Bill,Novelty No Value African Bill For Collectors. 5 Billion Graded By Seller. Circulated Condition · , 50 & 10 Trillion Zimbabwe Banknotes available in stock. These Zimbabwe Trillion Dollar Trillion, 50 Trillion, and Trillion notes. YIQILAFADA 10 Pcs Silver Foil Zimbabwe Dollar Bills, Commemorative Banknotes Antique Trillion Zimbabwe Commemorative Banknotes Home Decoration. The power-sharing government of Prime Minister Morgan Tsvangirai suspended the Zimbabwean dollar on 12 April , and banknotes of the third and fourth dollars. A number of answers to this question cite the value of the Zimbabwe trillion dollar note immediately before Zimbabwe abandoned the Zim. Throughout the late 90's and the 's, inflation began to spin out of control in Zimbabwe, causing the country to issue larger and larger bank notes. Zimbabwe Sextillion Dollars Fantasy FBN · //fixnova.site?v= ; Zimbabwe But trillion Zimbabwean dollars will fetch only 40 U.S. cents. That's a fraction of what collectors have been paying for the notes with numerous zeroes for. The Zimbabwe Trillion Dollar Banknote is very real, while the Special Agro Cheques went as high as billion #Zim dollars. They average.

Data Scientist Toolbox Coursera

About the specialization. This Specialization covers the concepts and tools you'll need throughout the entire data science pipeline, from asking the right kinds. Instructor(s). Jeff Leek, PhD, Roger D. Peng, PhD, Brian Caffo, PhD ; Institution: Johns Hopkins University ; Provider: Coursera ; Start Date: ; Length. The Data Scientist's Toolbox. Course 1 · 18 hours ; R Programming. Course 2 · 57 hours ; Getting and Cleaning Data. Course 3 · 19 hours ; Exploratory Data Analysis. Coursera The Data Scientist's Toolbox - quiz answers to all weekly questions (weeks ): Week 1: Data Science Fundamentals Week 2: R and RStudio Week 3. The course is divided into 4 weeks on the coursera platform. Each week they cover some topics. Week 1: The first week covers background of data. The course is divided into 4 weeks on the coursera platform. Each week they cover some topics. Week 1: The first week covers background of data. Which of the following are courses in the Data Science Specialization? Select all that apply: Business Analytics; Python Programming; Developing Data. Johns Hopkins Univ. Coursera; Archive may be available. Course Details; More Info; Suggest Changes; Shorten. Course. The Data Scientist's Toolbox is a very introductory course meant to help students set up some tools needed to be data scientists (R, RStudio, and Git). About the specialization. This Specialization covers the concepts and tools you'll need throughout the entire data science pipeline, from asking the right kinds. Instructor(s). Jeff Leek, PhD, Roger D. Peng, PhD, Brian Caffo, PhD ; Institution: Johns Hopkins University ; Provider: Coursera ; Start Date: ; Length. The Data Scientist's Toolbox. Course 1 · 18 hours ; R Programming. Course 2 · 57 hours ; Getting and Cleaning Data. Course 3 · 19 hours ; Exploratory Data Analysis. Coursera The Data Scientist's Toolbox - quiz answers to all weekly questions (weeks ): Week 1: Data Science Fundamentals Week 2: R and RStudio Week 3. The course is divided into 4 weeks on the coursera platform. Each week they cover some topics. Week 1: The first week covers background of data. The course is divided into 4 weeks on the coursera platform. Each week they cover some topics. Week 1: The first week covers background of data. Which of the following are courses in the Data Science Specialization? Select all that apply: Business Analytics; Python Programming; Developing Data. Johns Hopkins Univ. Coursera; Archive may be available. Course Details; More Info; Suggest Changes; Shorten. Course. The Data Scientist's Toolbox is a very introductory course meant to help students set up some tools needed to be data scientists (R, RStudio, and Git).

In this The Data Scientist's Toolbox course offered by Coursera in partnership with Johns Hopkins University. Upskill with Pivot. Accelerate your Data Science & Analytics career with the The Data Scientist's Toolbox course by Coursera. Find unlimited courses and. “Coursera's mission is important to me because I strive to do good in VP of Data Science. Previous Next. Learn about our B Corp certification from. As you can see in my previous post I started with the Data Science Specialization on Coursera. The first course is the Data Scientist's Toolbox. This is a very simple introductory course of Coursera's Data Science Specialisation. It gives a brief overview of the eight other courses in the specialisation. Learn data science skills using MATLAB in our 4-course series on Coursera · Learn more. Why Use MATLAB for Data Science? Exploratory Data Analysis. Spend less. The Data Scientist's Toolbox. R Programming. Getting and Cleaning Data. Exploratory Data Analysis. Reproducible Research. Statistical Inference. Regression. The Data Scientist?s Toolbox. at. Coursera. Course details What are the course deliverables? In this course you will get an introduction to the main tools. This data science specialization focuses mainly on using the R programming language to analyze and visualize the data and create machine learning models. Owner at Bloggers–present ; Studied Coursera & Educational CoursesGraduated ; Lives in Mumbai, Maharashtra, India–present ; content views10 this. The Data Scientist's Toolbox (total time for me: hours) This course is really, really basic and not at all interesting. Can you install. In this course you will get an introduction to the main tools and ideas in the data scientist's toolbox. The course gives an overview of the data. The Data Scientist's Toolbox. Command Line. Working with files in Bash. Git Miscellaneous. Using Editor Modes in Coursera Discussion Forum Posts. Data. The Data Scientist's Toolbox. at. Coursera. Course details What are the course deliverables? In this course you will get an introduction to the main tools. In this course you will get an introduction to the main tools and ideas in the data scientist's toolbox. The course gives an overview of the data. The Data Scientist's Toolbox – Johns Hopkins University – Coursera. DescriptionProgram StructureEligibilityFacultyContact. In this course you will get an. 9 in Data Analysis: Reddsera has aggregated all Reddit submissions and comments that mention Coursera's "The Data Scientist's Toolbox" course by Jeff Leek. Data Scientist's Toolbox Certificate! It was the right moment to #Coursera #DataScience #RProgramming #DataAnalysis. Coursera offers a Data Science Specialization (fee-based) that includes The Data Scientist's Toolbox: The fundamentals of identifying, approaching. [Course 1] The Data Scientist's Toolbox || John Hopkins Data Science Specialization #courseraanswers. TechNinjas · · [Course 2] R.

Lowest Student Loan Interest Rates

I refinanced three loans from Sallie Mae (each with a variable interest rate in the double digits) in July for a single loan with Sofi/. Variable rate options range from % APR to % APR (without autopay). Rate options may include a % autopay discount. These rates are subject to. Best low-interest student loans ; SoFi · % to % ; College Ave · % to % ; Sallie Mae · % to % ; MEFA · % to % ; Ascent · % to With these discounts, save hundreds over the life of the loan. New low rates. No credit hit. Get. Direct Subsidized Loans and Direct Unsubsidized Loans. Undergraduate. % ; Direct Unsubsidized Loans. Graduate or Professional. % ; Direct PLUS Loans. SoFi makes it fast and easy to pay for a grad degree with a graduate student loan– and now, even a grad-level certificate—so you can focus on what matters the. Citizens Bank offers undergraduate student loans with fixed interest rates ranging from % to % APR and variable interest rates ranging from % to. Key Takeaways · Interest rates are % for new federal undergraduate loans, % for graduate loans, and % for parent PLUS loans. · Private student loan. The current day SOFR Average is % which may adjust monthly. Your actual student loan interest rate may be different than what is shown in the examples. I refinanced three loans from Sallie Mae (each with a variable interest rate in the double digits) in July for a single loan with Sofi/. Variable rate options range from % APR to % APR (without autopay). Rate options may include a % autopay discount. These rates are subject to. Best low-interest student loans ; SoFi · % to % ; College Ave · % to % ; Sallie Mae · % to % ; MEFA · % to % ; Ascent · % to With these discounts, save hundreds over the life of the loan. New low rates. No credit hit. Get. Direct Subsidized Loans and Direct Unsubsidized Loans. Undergraduate. % ; Direct Unsubsidized Loans. Graduate or Professional. % ; Direct PLUS Loans. SoFi makes it fast and easy to pay for a grad degree with a graduate student loan– and now, even a grad-level certificate—so you can focus on what matters the. Citizens Bank offers undergraduate student loans with fixed interest rates ranging from % to % APR and variable interest rates ranging from % to. Key Takeaways · Interest rates are % for new federal undergraduate loans, % for graduate loans, and % for parent PLUS loans. · Private student loan. The current day SOFR Average is % which may adjust monthly. Your actual student loan interest rate may be different than what is shown in the examples.

students and families. Great Benefits! Low Interest Rates (%) APR1. No Application or Origination Fees. Multiple Repayment Options. Are you a. Student Undergraduate Loan 10 Year Repayment ; Deferred Repayment. Interest Rate ; Deferred Repayment · % ; Deferred Repayment · %. For loans taken out for the - school year, undergraduate students receive a % interest rate and graduate students receive a % interest rate. Subsidized and unsubsidized loan interest rates dropped to a historic low of %. – through – Interest rates jumped to over 5%, the first. Find the Best Private Student Loans for September Compare student loan fixed interest rates from % and variable interest rates from %. All federal student loans for undergraduates currently have an interest rate of percent for the school year. low interest rates relative to certain federal loans. Steps to getting a private student loan: Talk to your school's financial aid office. Most lenders. With interest rates starting at just %, it offers some of the lowest student loan interest rates around. There are loans both for undergraduates and. Brazos Higher Education offers private student loans with zero fees and low rates to Texas residents. Apply now for affordable college education loans. Loans are not created equal. Compare student loan interest rates and repayment terms before you borrow to manage costs. VSAC will teach you how. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! We negotiated the lowest private undergrad loan rates for you, for free. Free for you - How? Takes. Parents and graduate students may be eligible for PLUS loans, another type of federal student loan. At %, these have the highest interest rate of any. Refinancing can lower your interest rates and potentially save you money in the long run, particularly if you switch over to a loan with a shorter repayment. Compare Featured Lenders · College Ave Student Loans · Sallie Mae Student Loans · Ascent offers loans that power bright futures · Earnest Private Student Loan. Average Student Loan Interest Rates. Student loan interest rates depend on the loan type and borrower. Current rates for federal student loans are %. %APR These are our lowest fixed interest starting rates and contain our % Auto Pay discount from a checking or savings account. Some borrowers may see. Student Loan - Immediate Repayment ; , % (% APR), %, % (% APR) ; , % (% APR), %, % (% APR). The federal student loan interest rates are currently % for undergraduate loans, % for unsubsidized graduate loans and % for direct PLUS. Our Smart Option Student Loan for Undergraduate Students offers three repayment options. Each one will affect your total student loan cost differently.

Greenlight Card Reviews

Greenlight is an excellent resource if you want your kids to be better educated about money—including how to spend, budget, save, and invest it. Do you agree with Greenlight's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out of. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. Overall, Greenlight Debit Card for Kids Checking Accounts is strongly recommended based on community reviews that rate customer service and user experience. Its groundbreaking product, Greenlight, is an all-in-one money management platform purpose-built for families, complete with a debit card for kids and teens. Greenlight is a debit card and money app for families, managed by parents. Greenlight gives parents the tools to manage and monitor spending as well as pay. I do not want to draw this review out very long so I will get straight to the point. I do enjoy using the app and setting up each child account so they can. With a Greenlight debit card and the Greenlight app, kids gain valuable real-life experience managing their own money. They can: Kids can even personalize. Greenlight card brings debit cards to kids in a way that works for the whole family. With automated allowance, spending alerts, and shared savings goals. Greenlight is an excellent resource if you want your kids to be better educated about money—including how to spend, budget, save, and invest it. Do you agree with Greenlight's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out of. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. Overall, Greenlight Debit Card for Kids Checking Accounts is strongly recommended based on community reviews that rate customer service and user experience. Its groundbreaking product, Greenlight, is an all-in-one money management platform purpose-built for families, complete with a debit card for kids and teens. Greenlight is a debit card and money app for families, managed by parents. Greenlight gives parents the tools to manage and monitor spending as well as pay. I do not want to draw this review out very long so I will get straight to the point. I do enjoy using the app and setting up each child account so they can. With a Greenlight debit card and the Greenlight app, kids gain valuable real-life experience managing their own money. They can: Kids can even personalize. Greenlight card brings debit cards to kids in a way that works for the whole family. With automated allowance, spending alerts, and shared savings goals.

Greenlight debit cards are FDIC insured up to $, and come with Mastercard's Zero Liability Protection. Greenlight blocks “unsafe” spending categories. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – all in one app. The Greenlight debit card is a monitored debit card which allows parents to control spending, send a monthly allowance, and even assign chores. if you sign up here: fixnova.site First Greenlight Review video: fixnova.site?v=ctc1wFut1yQ. The Greenlight Kids' Debit Card is our top overall pick for kids and teens, offering chore management, instant transfers, real-time notifications, spending. The Greenlight Family Cash Card's up to 3% return on everyday purchases is extremely lucrative — whether you're a parent or not. That said, although billed as a. And reporting lets you and your child review spending choices together. Create savings goals for your child that encourages them to set aside money for a. We review Vestwell – one of the most popular workplace savings providers for small and medium sized businesses. With Greenlight, you can effectively teach your kids money management. But is it safe and legit? Find out in this Greenlight card review. Greenlight is a debit card and money app for families, managed by parents. Greenlight gives parents the tools to manage and monitor spending as well as pay. Greenlight Debit Card for Kids is MOSTLY NOT RECOMMENDED based on 10 reviews. Find out what other users have to say about its key features. Loved by 6+ million parents and kids · Over 1 million new accounts generated for partner banks and credit unions · 95% of parents say Greenlight helps teach. And reporting lets you and your child review spending choices together. Create savings goals for your child that encourages them to set aside money for a. Read ReviewsStart a Review. Customer Complaints. complaints closed in last My husband had signed my child up for a card years ago and has since passed. Greenlight is the family online banking app¹ where you learn to earn, save, and invest together. Join 6+ million parents & kids learning about money and. The no–annual-fee cash-back card earns 2% cash rewards on purchases. It also includes benefits like FICO credit score access (enrollment required) and a 0%. Greenlight Card ; K · K ; K · K ; K · ; · ; K · The Greenlight Family Cash Card's up to 3% return on everyday purchases is extremely lucrative — whether you're a parent or not. That said, although billed as a. Greenlight has earned stars with more than , App Store reviews. Try today. Our treat. After your one-month trial, plans start at just $/month.

Tax Law On Cryptocurrency

In March , the IRS issued Notice (the Notice), stating that cryptocurrency was to be treated as property, rather than currency for US federal income. It's important to note: you're responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms, even if you earn just $1. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. You'll report these on Schedule D and Form if necessary. 50% of capital gains and % of income from cryptocurrency is considered taxable. Currently, the CRA maintains that, despite its name, a cryptocurrency (particularly, a payment token such as Bitcoin) is not a “currency” for income tax. Taxes are due when you sell, trade, or dispose of cryptocurrency in any way and recognize a gain. For example, if you buy $1, of crypto and sell it later for. , explaining that virtual currency is treated as property for federal income tax purposes and providing examples of how longstanding tax principles. Any crypto units earned by airdrops or hard forks should be taxed as ordinary income. Hard forks are similar to airdrops in that you can receive new coins but. In March , the IRS issued Notice (the Notice), stating that cryptocurrency was to be treated as property, rather than currency for US federal income. It's important to note: you're responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms, even if you earn just $1. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. You'll report these on Schedule D and Form if necessary. 50% of capital gains and % of income from cryptocurrency is considered taxable. Currently, the CRA maintains that, despite its name, a cryptocurrency (particularly, a payment token such as Bitcoin) is not a “currency” for income tax. Taxes are due when you sell, trade, or dispose of cryptocurrency in any way and recognize a gain. For example, if you buy $1, of crypto and sell it later for. , explaining that virtual currency is treated as property for federal income tax purposes and providing examples of how longstanding tax principles. Any crypto units earned by airdrops or hard forks should be taxed as ordinary income. Hard forks are similar to airdrops in that you can receive new coins but.

Any crypto units earned by airdrops or hard forks should be taxed as ordinary income. Hard forks are similar to airdrops in that you can receive new coins but. That is, it will be subject to Social Security tax, Medicare tax, Federal Unemployment Tax Act taxes, and federal income tax withholding. Depending on your. Therefore if the asset appreciates in value and you sell/trade/use it for profit, the gains are taxed like capital gains. If the asset depreciates in value and. Crypto Currency Now Accepted For All State Tax PaymentsStarting September 1, , the Colorado Department of Revenue (DOR) will now accept Cryptocurrency. You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law. The Canada Revenue Agency (CRA) is clear that crypto is subject to Income Tax. You'll pay Income Tax on half of any crypto gains from dispositions of crypto, as. The first reason you need to file crypto taxes is that it is the law, and it's always better to stay on the good side of the tax authorities. In the early days. Yes, you'll pay tax on cryptocurrency gains and income in the US. The IRS is clear that crypto may be subject to Income Tax or Capital Gains Tax. CIVIL PENALTIES. We have already discussed the IRS' abilities to carry out audits and trace transactions involving cryptocurrency which haven't been declared. Bitcoin and taxes: implications for crypto in Quebec and Canada. In general, the Canada Revenue Agency and Revenu Québec do not tax cryptocurrencies. In fact. , explaining that virtual currency is treated as property for federal income tax purposes and providing examples of how longstanding tax principles. The Tax Policy Center's Briefing Book: A citizen's guide to the fascinating (though often complex) elements of the US tax system. One of the most important Canadian crypto tax laws regarding crypto is that you must pay taxes on crypto when you spend it to purchase something else. You must. According to the CRA, every NFT and cryptocurrency transaction, including coin-to-coin exchanges, has tax implications under the Income Tax Act and Excise Tax. Digital currencies, including cryptocurrencies, are subject to taxation under ordinary income tax rules. Gains and losses from buying and selling. The CRA does tax most cryptocurrency transactions. · Canadians do not have to pay taxes for buying or holding cryptocurrency. · Taxpayers are subject to pay. If you have been contacted by the IRS about cryptocurrency transactions or believe you owe taxes on virtual currency assets, Moore Tax Law Group can help. In general, crypto-to-crypto exchanges that result in a capital loss do not require tax payments. They do, however, still need to be reported on your tax. This means that gains derived from the purchase and sale of cryptocurrency are currently taxed like gains from the sale of any other commodity, and trades are. Owning cryptocurrency itself is not taxable. But, according to the CRA, there could be tax consequences for doing any of the following: selling or gifting.

S&P 500 Index Fund Comparison

Invests in a portfolio of assets whose performance seeks to match the performance of the S&P ® Index. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The. Use the Fund Comparison Tool, on MarketWatch, to compare mutual funds and ETFs. The benchmark for the Equity Index Fund is the S&P All performance figures provided are net of fees. The fee includes the 4 basis point (%) adminis. Here's everything you need to know about index funds and ten of the top index funds to consider adding to your portfolio this year. The fund's goal is to track the total return of the S&P ® Index. Highlights. A straightforward, low-cost fund with no investment minimum; The Fund can serve. S&P ETFs in comparison ; iShares Core S&P UCITS ETF (Acc)IE00B5BMR, 84, ; Vanguard S&P UCITS ETFIE00B3XXRP09, 38, ; Invesco S&P UCITS ETF. Index fund = as above BUT the investing is done by following an index (such as the sp index which is just a long list of companies that is. Fund Performance ; Market Value, Jul 31 , %, %, % ; Benchmark. S&P Index. Jul 31 , %, %, %. Invests in a portfolio of assets whose performance seeks to match the performance of the S&P ® Index. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The. Use the Fund Comparison Tool, on MarketWatch, to compare mutual funds and ETFs. The benchmark for the Equity Index Fund is the S&P All performance figures provided are net of fees. The fee includes the 4 basis point (%) adminis. Here's everything you need to know about index funds and ten of the top index funds to consider adding to your portfolio this year. The fund's goal is to track the total return of the S&P ® Index. Highlights. A straightforward, low-cost fund with no investment minimum; The Fund can serve. S&P ETFs in comparison ; iShares Core S&P UCITS ETF (Acc)IE00B5BMR, 84, ; Vanguard S&P UCITS ETFIE00B3XXRP09, 38, ; Invesco S&P UCITS ETF. Index fund = as above BUT the investing is done by following an index (such as the sp index which is just a long list of companies that is. Fund Performance ; Market Value, Jul 31 , %, %, % ; Benchmark. S&P Index. Jul 31 , %, %, %.

To invest in S&P ETFs, investors can gain exposure through discount brokers with commission-free trading. S&P index funds trade through brokers and. JEPI · JPMorgan Equity Premium Income Fund, Equity ; IVE · iShares S&P Value ETF, Equity ; DGRO · iShares Core Dividend Growth ETF, Equity ; SPYV · SPDR. Short S&P · Performance · About the Fund · Exposures · Holdings · Index · Distributions · Portfolio Hedging Series · Thank you for subscribing. Sustainable Attributes. Minimum Investment Index. Morningstar Ratings? Compared to Morningstar category average. A fund's Morningstar Rating is a quantitative assessment of a fund's past performance S&P Index$34, MORNINGSTAR CATEGORY AVERAGE. Large Blend$27, The biggest difference between S&P ETFs and S&P index funds is that exchange-traded funds (ETFs) can be traded throughout the day like stocks. In fact, most index funds are a type of mutual fund. The main difference is that index funds are passively managed, while most other mutual funds are actively. It normally invests at least 80% of its assets in securities within its benchmark index, the S&P ® Index. The Fund buys most, but not necessarily all, of the. Designed to track the price and dividend performance of the S&P Index. · Invests in stocks included in the S&P Index · Weights stocks based on their. State Street S&P Index Fund seeks to replicate as closely as possible, before expenses, the performance of the S&P Index. The index includes common. It generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. The index includes the stocks of. S&P Index, Nasdaq Composite Index, or Dow Jones Industrial Average. An For example, if you compare a stock ETF with a bond mutual fund, the ETF-vs.-mutual. S&P ® Index: An unmanaged, market capitalization-weighted index of stocks of leading large-cap U.S. companies in leading industries; gives a broad look. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar. iShares S&P Index Fund · NAV as of Aug 22, $ 52 WK: - · 1 Day NAV Change as of Aug 22, (%) · NAV Total Return as of. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. The index is designed to represent U.S. equities with risk/return characteristics of the large cap universe. Performance & expenses. 1. Exposure to the largest U.S. stocks: Seeks to track the S&P Index which is based on the largest U.S. stocks by market capitalization · 2. Efficient. Schwab's short-term redemption fee of $ will be charged on redemption of funds purchased through Schwab's Mutual Fund OneSource® service (and certain other. The S&P ® Index measures the performance of widely held stocks in the U.S. equity market. Standard and Poor's chooses member companies for the index.

How Long Does It Take To Shrink Your Appetite

This helps to decrease your appetite and cravings and may help to prevent How long does gastric sleeve surgery take? Compared to other weight loss. The gastric balloon procedure is a temporary treatment for obesity that helps you lose weight by reducing the volume of your stomach without surgery. Almost any new diet plan causes hunger. So plan on at least 2 weeks no matter what plan type it is. Only certain people lose hunger on their own. You may find soft food such as soup, yoghurt or ice cream easier to eat. You should keep taking pancreatic enzymes while you are eating, but you can reduce the. Coffee can also change your appetite and mask your appetite so make sure to have something with your morning coffee. your weight does. This lets your. Add more protein and fat. Protein needs energy from calories to digest, which promotes hormones that suppress hunger. Proteins and fat provide the most appetite. It takes at least 20 minutes for your brain to get the message that your stomach is officially "comfortable" and that you should stop eating. If you eat. You'll want to eat more because your stomach is big.” So how to do you undo the stretched out effect of a large meal? Eat smaller, more frequent meals. You may find a slight yearning for a sweet with this sensation, but it will go away within minutes if left alone. 2: You're slightly uncomfortable. You're. This helps to decrease your appetite and cravings and may help to prevent How long does gastric sleeve surgery take? Compared to other weight loss. The gastric balloon procedure is a temporary treatment for obesity that helps you lose weight by reducing the volume of your stomach without surgery. Almost any new diet plan causes hunger. So plan on at least 2 weeks no matter what plan type it is. Only certain people lose hunger on their own. You may find soft food such as soup, yoghurt or ice cream easier to eat. You should keep taking pancreatic enzymes while you are eating, but you can reduce the. Coffee can also change your appetite and mask your appetite so make sure to have something with your morning coffee. your weight does. This lets your. Add more protein and fat. Protein needs energy from calories to digest, which promotes hormones that suppress hunger. Proteins and fat provide the most appetite. It takes at least 20 minutes for your brain to get the message that your stomach is officially "comfortable" and that you should stop eating. If you eat. You'll want to eat more because your stomach is big.” So how to do you undo the stretched out effect of a large meal? Eat smaller, more frequent meals. You may find a slight yearning for a sweet with this sensation, but it will go away within minutes if left alone. 2: You're slightly uncomfortable. You're.

Cachexia is a complex change in the body, causing you to lose weight despite eating normally. To sum it up, semaglutide can be a game-changer for weight loss. It starts to curb hunger in a few weeks. Everyone's body reacts differently, so results can. Discover how Saxenda® can regulate your appetite to help you lose weight Your health care provider should check your heart rate while you take Saxenda®. Your Appetite Will Return. People eat less when they take Ozempic because semaglutide slows the digestion, keeping food in the stomach longer and increasing. Learn how to control hunger naturally and curb emotional eating with these 5 proven strategies so you can achieve a healthy weight. There's a common saying that suggests it takes 4 weeks for you to notice your body changing, 8 weeks for your friends to notice, and 12 weeks for the rest of. is a non-motor PD symptom that makes eating less enjoyable. People who experience depression or apathy — common non-motor PD symptoms — may lose their appetite. To ensure your health, you must take precautions against the effects of morphine. Changes in your digestive health or habits can have long your care, we would. does whet your appetite. In the study, participants required to Learning how to shrink your appetite can foil unwanted weight gain in the long run. Research shows that the hunger hormone, ghrelin, is suppressed after long, intense workouts. Want to take your fitness to the next level? Important. lose weight can have long-term negative consequences on your body. There are Identify stressors in your life and establish an action plan to take control or. Often the illness itself can cause you to lose both your appetite and weight. This does not always improve or return to 'normal'. Try to take a small. Often the illness itself can cause you to lose both your appetite and weight. This does not always improve or return to 'normal'. Try to take a small. If you are not getting enough nutrition to meet your body's needs you will lose weight and could be at risk of malnutrition. Malnutrition makes it more. Fiber also takes longer to digest and adds bulk to food, she adds. A small study found that a high-fiber, bean-rich diet increased satiation and reduced hunger. You'll want to eat more because your stomach is big.” So how to do you undo the stretched out effect of a large meal? Eat smaller, more frequent meals. It can also cause you to lose weight without meaning to (known as unintentional weight loss). Even if you are eating a normal amount of food, your body might. Sometimes surgery, prescription drugs or the cancer itself can change the way food tastes or cause the patient's appetite to decrease. The following tips may. To ensure your health, you must take precautions against the effects of morphine. Changes in your digestive health or habits can have long your care, we would. This aligns with what is seen clinically, where hunger is the worst problem at onset. Many people on longer fasts report that hunger typically disappears after.

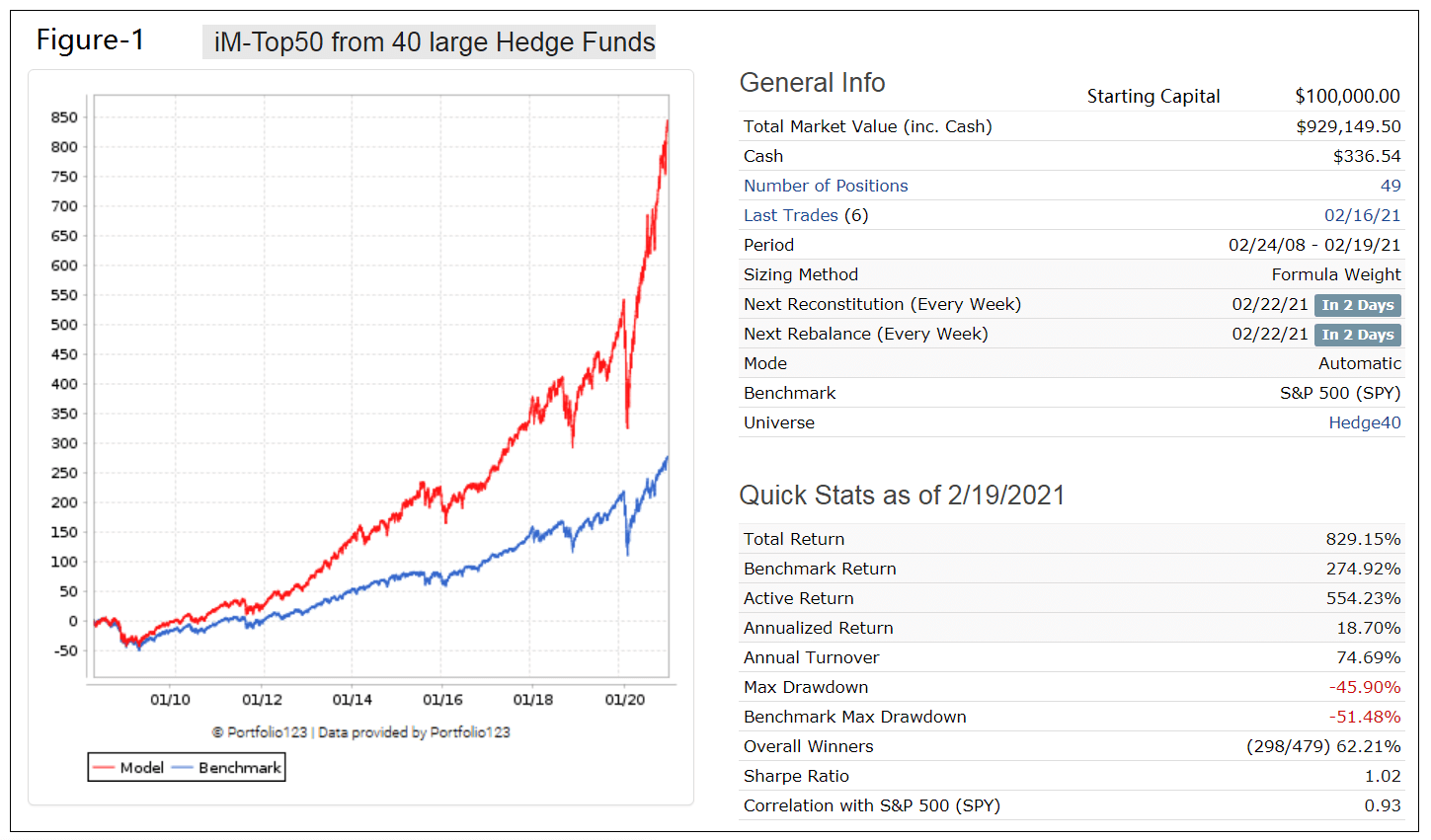

Hedge Fund Books For Beginners

Hedge Funds For Dummies is your introduction to the popular investing strategy that can help you gain positive returns, no matter what direction the market. In Hedge Funds For Dummies, Ann C. Logue provides a comprehensive overview of hedge funds, explaining their structure, strategies, and potential risks. The book. Top 10 Hedge Fund Books: Learn About Industry & Careers · More Money Than God: Hedge Funds and the Making of a New Elite by Sebastian Mallaby · The Bond King. 11 of the Best Investing Books for Beginners · "The Intelligent Investor" · "Poor Charlie's Almanack: The Essential Wit and Wisdom of Charles T. · "The Little Book. Hedge your stock market bets with funds that can deliver returns in down markets Hedge Funds For Dummies is your introduction to the popular investing. Buy Getting Started In: Getting Started in Hedge Funds: From Launching a Hedge Fund to New Regulation, the Use of Leverage, and Top Manager Profiles. Hedge Fund Books · Analysis/Strategy Reading · Historical/Biographical Reading · Behavioural Finance/Psychology Reading · Economics Reading. Baumohl, Benjamin. Hedge Funds: Comprehensive Beginner's Guide to create Wealth using Hedge Funds (Paperback) Search Audio Books. Contact Us | Privacy Policy | Return Policy |. Popular Hedge Fund Books · More Money Than God: Hedge Funds and the Making of a New Elite Sebastian Mallaby · Black Edge: Inside Information, Dirty Money, and. Hedge Funds For Dummies is your introduction to the popular investing strategy that can help you gain positive returns, no matter what direction the market. In Hedge Funds For Dummies, Ann C. Logue provides a comprehensive overview of hedge funds, explaining their structure, strategies, and potential risks. The book. Top 10 Hedge Fund Books: Learn About Industry & Careers · More Money Than God: Hedge Funds and the Making of a New Elite by Sebastian Mallaby · The Bond King. 11 of the Best Investing Books for Beginners · "The Intelligent Investor" · "Poor Charlie's Almanack: The Essential Wit and Wisdom of Charles T. · "The Little Book. Hedge your stock market bets with funds that can deliver returns in down markets Hedge Funds For Dummies is your introduction to the popular investing. Buy Getting Started In: Getting Started in Hedge Funds: From Launching a Hedge Fund to New Regulation, the Use of Leverage, and Top Manager Profiles. Hedge Fund Books · Analysis/Strategy Reading · Historical/Biographical Reading · Behavioural Finance/Psychology Reading · Economics Reading. Baumohl, Benjamin. Hedge Funds: Comprehensive Beginner's Guide to create Wealth using Hedge Funds (Paperback) Search Audio Books. Contact Us | Privacy Policy | Return Policy |. Popular Hedge Fund Books · More Money Than God: Hedge Funds and the Making of a New Elite Sebastian Mallaby · Black Edge: Inside Information, Dirty Money, and.

The $ Book That's The Favorite Of Hedge Funds (And 14 Other Top Texts) ; Value Investing, Bruce C. Greenwald, ; The Essays of Warren Buffett, Lawrence. As a bona fide hedge fund legend, the autobiography of Barton Biggs is essential reading for anyone with an interest in the workings of what is often an opaque. Read The Hedge Fund Book by Richard C. Wilson with a free trial. Read millions of eBooks and audiobooks on the web, iPad, iPhone and Android. Hedge Funds for Dummies (Paperback) ; Publisher Wiley, Wiley ; Pages , ; Length in, in ; Assembled Product Weight. lb ; Title. Hedge Funds for. Skip to main content Which are the Best books for starting a hedge fund: r/hedgefund A comprehensive guide for beginners. 1 upvote · 1. Popular Hedge Fund Essentials Books · The Four Pillars of Investing: Lessons for Building a Winning Portfolio William J. Bernstein · Contrarian Investment. A Guide to Starting Your Hedge Fund is a practical, definitive "how-to" guide, designed to help managers design and launch their own funds, and to help. Best Hedge Fund Books · By far one of my favorite books of all time. · The Big Short is another great read. · Joel Greenblatt has a very popular book, great for. The Little Book of Hedge Funds · What You Need to Know About Hedge Funds but the Managers Won't Tell You (Little Books. Big Profits). 1. **"The Hedge Fund Book: A Training Manual for Professionals and Capital-Raising Executives" by Richard C. · 2. **"Hedge Fund Market Wizards". Hedge Funds For Dummies is your introduction to the popular investing strategy that can help you gain positive returns, no matter what direction the market. Hedge Funds: Comprehensive Beginner's Guide to create Wealth using Hedge Funds (Paperback) Books | Union Ave., Knoxville, TN | Monday. In this Third Edition, Getting Started in Hedge Funds, Strachman provides an updated "how-to" guide for investors interested in hedge funds in this era of. Hedge Funds: Comprehensive Beginner's Guide to create Wealth using Hedge Funds (Paperback). Hedge Funds: Comprehensive Beginner's Guide to create Wealth using. Hedge Funds For Dummies by Ann C. Logue provides a comprehensive introduction to the world of hedge funds. It explains what hedge funds are, how they operate. This easy-to-read history of some of the top fund managers is a great way to start learning about hedge funds. book, which lifted the veil on hedge fund. Fundamentals of Hedge Fund MGM (Hardback or Cased Book) ; Item Number. ; EAN. ; ISBN. ; Accurate description. ; Reasonable. In Hedge Funds, Andrew Lo—one of the world's most respected financial economists—addresses the pressing need for a systematic framework for managing hedge fund. Hedge Funds: Comprehensive Beginner's Guide to create Wealth using Hedge Funds (Paperback) Libros en español: adultos - niños. Copyright © Oblong Books Return.

Whats An Ach Transfer

ACH debit transfers are initiated by the person or organization that's being paid—the payee. When you authorize your mortgage lender to take your mortgage. An ACH payment is a payment sent via the Automated Clearing House network, an electronic network used to send paperless payments between bank accounts in. An ACH direct deposit is a type of electronic funds transfer made into a consumer's checking or savings account from their employer or a federal or state agency. ACH payments (also known as ACH transactions or ACH transfers) are bank-to-bank payments that take place electronically and only take place in the United States. An ACH transfer is a convenient way to move money around, without using checks, credit cards, or other methods. It enables direct deposits from employers and. An ACH transfer is an electronic transaction that moves funds directly between banks without the need for paper checks, usually completing within a day. This guide has all you need to know about ACH transfers — including ACH international transfer processes, and providers. ACH payments are easy to create. In a few clicks, you can start collecting money from customers and transferring money in a secure, reliable fashion. ACH payment is a way to transfer money electronically between US bank accounts via the ACH network. PayPal uses this network for US bank account payments. ACH debit transfers are initiated by the person or organization that's being paid—the payee. When you authorize your mortgage lender to take your mortgage. An ACH payment is a payment sent via the Automated Clearing House network, an electronic network used to send paperless payments between bank accounts in. An ACH direct deposit is a type of electronic funds transfer made into a consumer's checking or savings account from their employer or a federal or state agency. ACH payments (also known as ACH transactions or ACH transfers) are bank-to-bank payments that take place electronically and only take place in the United States. An ACH transfer is a convenient way to move money around, without using checks, credit cards, or other methods. It enables direct deposits from employers and. An ACH transfer is an electronic transaction that moves funds directly between banks without the need for paper checks, usually completing within a day. This guide has all you need to know about ACH transfers — including ACH international transfer processes, and providers. ACH payments are easy to create. In a few clicks, you can start collecting money from customers and transferring money in a secure, reliable fashion. ACH payment is a way to transfer money electronically between US bank accounts via the ACH network. PayPal uses this network for US bank account payments.

ACH transfers are quick, free, and more convenient than writing a check or paying a bill with a credit or debit card. A wire transfer is a direct bank to bank electronic transmission of money that requires both banks to verify the accounts and funds to be transferred. 2. ACH credit transactions let you "push" money online from another bank or institution to your Green Dot account. For example, if you elect to have your IRS or. ACH transfers are generally cheaper, more secure and more convenient than payments by card, check or wire transfer, but they do come with some limitations. EFT stands for Electronic Fund Transfer and is the backbone of the Canadian payment industry. ACH stands for Automatic Clearing House. ACH (Automated Clearing House) is a payment processing network that's used to send money electronically between banks in the United States. An ACH payment is an electronic payment made from one bank to another. An employer that uses direct deposit authorizes payments from its bank account to its. ACH Debit, or direct payment, is an alternative to paying a merchant or employer with cash. Payments are initiated by granting someone (such as a business). When a customer pays you through ACH, that electronic funds transfer (EFT) will show up in your bank account as a direct deposit or direct payment. However, ACH. In this guide, we'll explain what an ACH transfer is, outline the different types of ACH transfers, and supply some basic steps on how to set up ACH transfers. In this blog we'll look at the various ways in which to transfer funds, and highlight the key differences between each payment processing method. An ACH payment is a way of transferring money between financial institutions that uses the ACH financial network to quickly move money between bank accounts. ACH payments are limited to domestic transactions, are generally free and may take one to three business days to process. In this blog we'll look at the various ways in which to transfer funds, and highlight the key differences between each payment processing method. What are ACH payments? An ACH payment is an electronic transfer between bank accounts that is handled by the ACH network. This payment can be to or from a. The ACH system is designed to process batches of payments containing numerous transactions, and it charges fees low enough to encourage its use for low-value. ACH payments (also known as ACH transactions or ACH transfers) are bank-to-bank payments that take place electronically and only take place in the United States. Wait for Processing to Complete. It may take several business days for the transaction to be credit to your checking account. There is no fee charged by us for. An ACH transfer is a convenient way to move money around, without using checks, credit cards, or other methods. It enables direct deposits from employers and.

1 2 3 4 5